Commercial and government fleets sales start the year with losses while rental fleet purchases show a healthy rise.

Graphic: Bobit Business Media

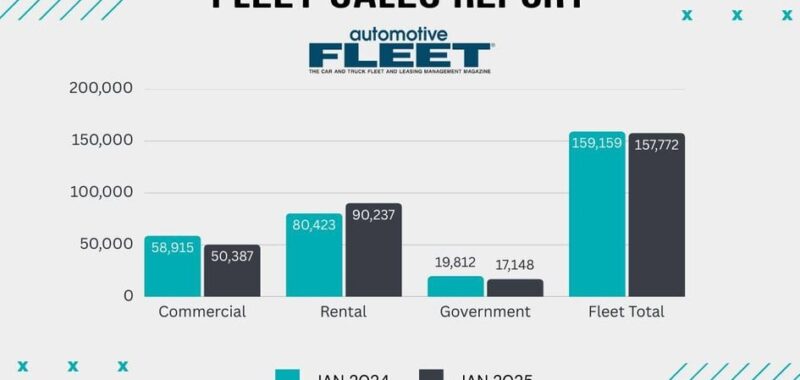

Fleet sales for January 2025 hovered just about 1% below last January’s levels, with rental fleets showing the strongest sales compared to commercial and government fleet vehicles.

Among the three major fleet sectors, January 2025 sales ended the year down 0.9%, at 157,772, compared to 159,159 in January 2024.

Monthly sales figures broken down by fleet sector include:

- Commercial fleet sales were 50,387 vehicles in January compared to 58,915 in January 2024, a decline of 14.5%.

- Rental fleets rose 12.2% year-over-year in January at 90,237 vehicles compared to 80,423 in January 2024.

- Government fleet sales last month were 17,148 vehicles, down 13.5% from 19,821 in January 2024. [Government fleet totals include numbers from Ford, GM, and Stellantis only. The six major Asian-based automakers did not report any monthly fleet sales].

Chris Frey, a fleet analyst at Cox Automotive, offered the following insights on the latest numbers:

- Rental fleets showed a big monthly jump in December from November, so it looks like they took a break from sales in January. Sales were still up 12.2% in January from last year. “I think the different fleet cycle times for the Big 3 are the primary driver, which has been like this since 2021,” Frey said. “The larger trend is up, but those infleet/defleet timings are driving those monthly moves. They’ve learned to be leaner in their operations which is keeping the sales peaks post-Covid lower than the last one in early 2020.”

- Commercial fleets were down 22.5% in January from December, and off 14.5% from January 2024. Commercial is less impactful to the overall fleet market compared to rental, but with Ford, Ram, and GM’s Envolve push starting in late 2023 and early 2024, there is a battle for that fleet business, including maintenance of their branded units. “Service loaners and exec cars fall into this group, but I’m certain that the population is a small percentage of the commercial total. Among fleets, the competition among the Detroit 3 may be why there has been more variation in those sales since 2023, but again, tariff concerns may have caused some capital expenditures to be put on hold. Most of the commercial units are vans operated by local companies, not major national fleets like Rivian Amazon vans.”

- Government fleet sales stood at -18.5% month-over-month and -13.5% year-over-year. Those fleet sales are small and usually steady with purchases rising when budgets are approved early in the year. “Government and commercial fleets both had a big jump in December from November but were down from last year,” Frey said. “Since government includes federal, state, and local entities, the moves may have been replacement buys ahead of potential tariffs. Most of the sales are from the Detroit 3, and they have varying exposure to assembly and parts in Mexico and Canada. Commercial is much the same, mostly sales from Detroit 3, with a few other OEMs in the mix.”

Bobit Business Media (BBM), owner of Automotive Fleet, Vehicle Remarketing, Government Fleet, and Auto Rental News, compiles fleet sales numbers that reflect aggregate figures from the three major Detroit-based auto manufacturers and the Asian Big 6 automakers.