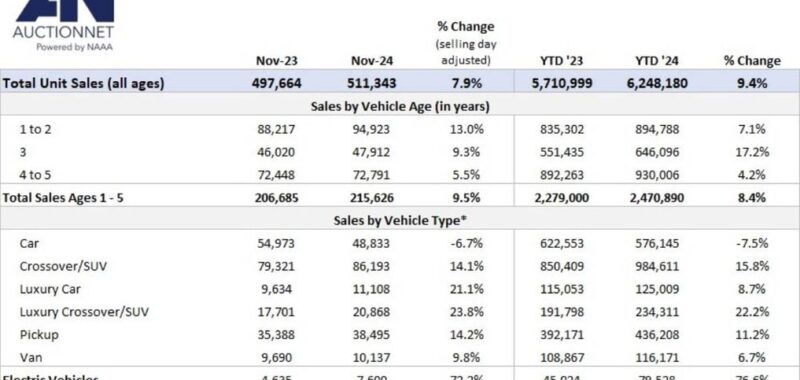

On a selling day adjusted basis, auction sales of vehicles up to 5-years-old — which includes most off-lease, rental, and fleet company sales — rose 9.5% compared to last November.

Wholesale vehicle auction sales during the first eleven months of this year reached 6.25 million units, a rise of 9.4% versus 2023’s YTD total, making auction volume the highest recorded since 2019 when sales reached 7.56 million units during the same period, according to AuctionNet data released Dec. 10.

However, 2024 YTD sales are still 17% below 2019 levels.

In November, AuctionNet wholesale auction sales reached 511,343 units, up 7.9% on a prior year basis after adjusting for selling day differences. This November had one more selling day than last year. Sales fell 1.6% over the Thanksgiving holiday-shortened month compared to October.

As has been the case all year, commercial volume has been the primary catalyst behind the year’s sales growth.

The trend continued in November as commercial sales were 14.4% higher versus November 2023 (selling day adjusted). Dealer sales were also higher compared to last November, rising 5.1%. Year-to-date, commercial sales are 24.3% higher than in 2023, while dealer sales are down a slight 0.2%.

On a selling day adjusted basis, auction sales of vehicles up to 5-years-old — which includes most off-lease, rental, and fleet company sales — rose 9.5% compared to last November.

Within this age group:

- Sales grew 13% year-over-year for 1-to-2-year-old vehicles, which reflects more rental vehicles being remarketed over the month than last year.

- 3-year-old sales grew by more than 9% compared to last November. But the rate of growth was well below the 19% average recorded over most of the year.

- 4-to-5-year-old volume was up 5.5%, led by a 12% increase in 5-year-old vehicle sales (i.e., model year 2019).

Non-luxury car auction sales continued to trend lower last month, with volume down 6.7% versus last November. Light truck sales continued to pick up the car slack, as sales of CUVs, SUVs, large pickups, and vans rose 15.5% year-over-year in November.

Non-luxury car auction sales continued to trend lower last month, with volume down 6.7% versus last November. Light truck sales continued to pick up the car slack, as sales of CUVs, SUVs, large pickups, and vans rose a combined 15.5% year-over-year in November.

As a collective, late model (up to 5-years-old) compact and midsize CUV/SUV auction sales are up 17% year-to-date, while volume for their luxury equivalents is up more than 24%. Later model large pickup sales were nearly 6% higher through November than last year.

Turning to electric vehicle sales, later model EV auction volume was robust in November, exceeding 7,600 units, a 72.2% increase compared to last November (selling day adjusted).

While strong, year-over-year growth is moderating, but this should be expected considering that EV volume has grown substantially over the past year-plus. Note that Tesla models comprise 57% of auction sales YTD.

While EV wholesale prices are far more depressed than otherwise, prices for certain EVs, such as Teslas, improved last month compared to October, which could be due, in part, to more EVs falling below the $25,000 threshold required to qualify for the federal used clean vehicle tax credit.

Monthly AuctionNet data is derived from 265 NAAA member auctions that use AuctionNet. It is considered the most comprehensive source of wholesale auto auction sales data in the U.S.